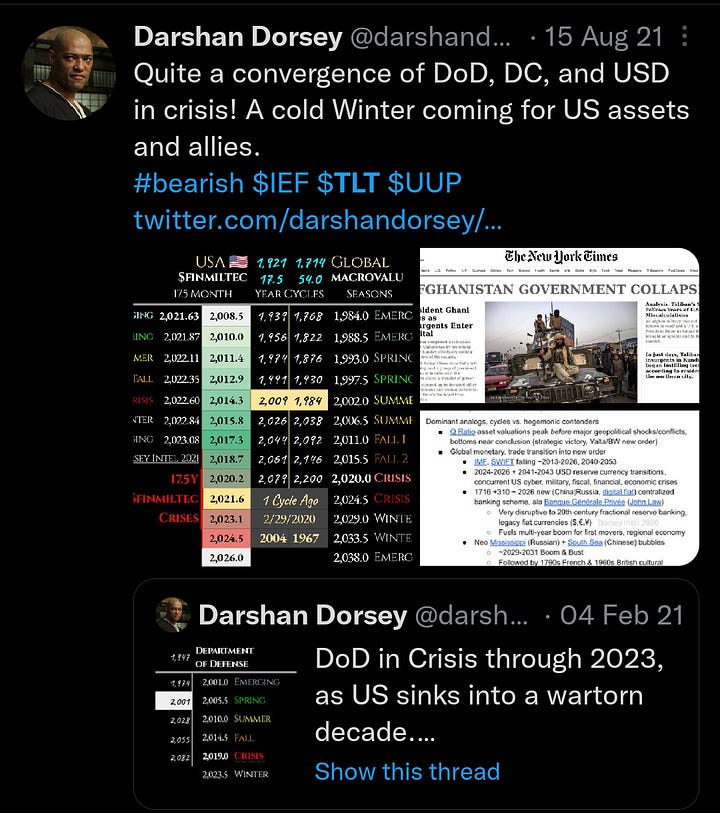

Happy Halloweekend all! We're getting a bit more pragmatic here, as this Fourth Turning finale and WW3 ramp up. Like it or not, interesting times like these compel us to put on our forecasting and risk manager hats. Fortunately, a dozen years of Dorsey Intel analytics + AI greatly simplify this process. First, some truly data driven quant exhibits:

From national equity/stock markets to Credit Default Swaps, Turkey/Ankara/Erdogan feature prominently and 🐻bearishly. Turkey's strategic geography between Europe and the Middle East gives it an important regional security role. Erdogan's Turkey, however, is moving away from NATO and the Western Liberal Order, refocusing on national priorities in the spirit of Atatürk.

Such maneuvering raises risks of fallout when (not if) a smaller conflict and/or domestic crisis escalates into a great power war between NATO and Beijing/BRICS proxies (headlined by Israel v Iran). Complex conflicts in Iraq, Syria, and Yemen offer important lessons for next generation wars of the 2020s.

Prolonged fighting disrupts vital Turkish (and Kurdish) O&G pipelines and shipping routes. Commerce and tourism could also crash, as travel restrictions and security concerns take their toll. Capital flight to safe havens like gold and cryptocurrency likely sink the Lira and Turkish markets. Persistent conflict pressures Turkish asset prices and macro short-intermediate term, offset by fast growing domestic aerospace, defense, and drone/robotics industry benefiting from Ankara's rise as an indispensable (military) ally.

Tensions with the West come to a head 2024-2026, as Turkey moves to assert greater influence amidst the chaos, while Washington goes all-in on losing hands in Kyiv and Tel Aviv. This could catalyze a break with NATO, as Erdogan overplays his own hand geopolitically. The risks of miscalculation and overreach increase, as leaders react to rapidly changing threats. Such a dramatic split could handicap Turkey and former allies for years.

NATO turmoil would worsen an already fragile backdrop for Western/US sovereign credit in late 2023. Ongoing recession risks, debt ceiling fights, and low public approval of both parties could undermine confidence in US institutions and military strength. This (and fiscal+monetary devaluation) will batter the dollar lower through 2026. Whatever crisis strikes US debt in Q4’23 should mark a high in yields, and a Treasury buying opportunity as the Fed steps in with monetary relief. As US rates fall into 2024, < 2Y Treasuries and bills look more attractive (🐂SHY), as the yield curve normalizes and short end drops significantly.

Capital flight from €uro and US$ into safer havens like precious metals (🐂SLV) and cryptocurrency (🐂BTC) will accelerate. Waning faith in the US ability to utilize its military effectively and broker lasting alliances would be seen as symptomatic of a superpower in relative decline. Expect China, Russia, and other BRICS+ to become more assertive, accruing capital inflows and macroeconomic benefits. Saudi Arabia-India-(South)Africa, BTCrypto, EM bonds and banks like HDB, and Semiconductors look most 🐂bullish over the next 1-4 months, while 🐻hedging/selling Turkey-Vietnam-Japan, Insurers like BRK, Energy, and Agricultural inputs like ELAN and MOS:

With military commitments under fire across the Middle East, Asia and Eastern Europe, the Federal Reserve and other Central Banks likely intervene directly to calm US/global markets. Quantitative easing (vs. tightening) may returns to backstop asset prices, and guard against a loss of SWIFT supremacy.

Lower energy prices, rates, and probable stimulus from late 2023 offer some economic relief, benefiting Big Auto, Media, Pharma, and Airlines (🐂F,NFLX,WBA,JETS) at the expense of energy commodities and EVs (🐻BTU,URA,USO,RIVN).

While Europe aligns with the US to present a united front, internally, developed Western economies will suffer from reduced capital, energy, and trade flows. Lingering recession, refugee influxes, and populist backlash will pressure fiat currencies like USD and Euro, as well as European debt markets:

Meanwhile, Japanese automakers and the broader economy could be hit hard by trade warring combined with volatile energy and input costs (🐻TM,EWJ). Geographic proximity to regional conflicts would spark security fears and macroeconomic friction. While Bank of Japan intervention and support are likely, crisis management is limited by Japan’s weak demographics and debt.

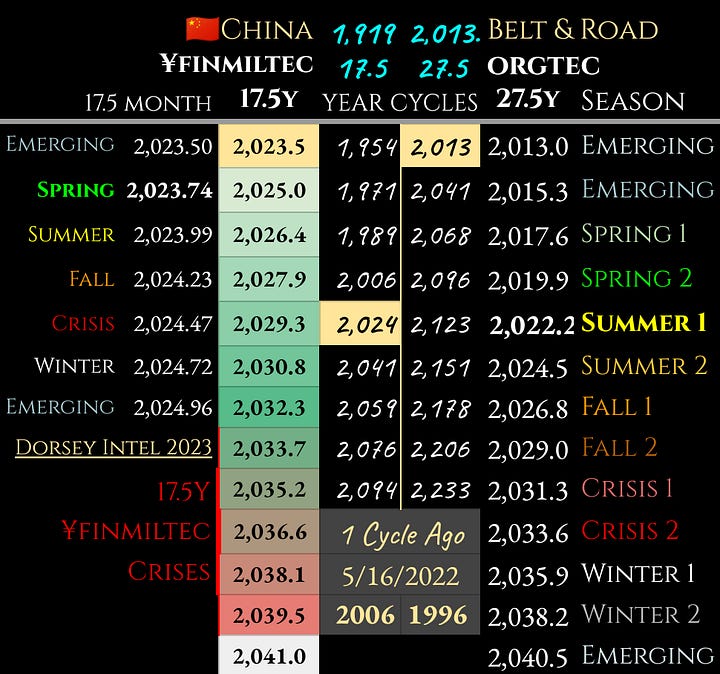

In contrast to struggling NATO powers, China could solidify relationships across Asia and the Middle East. Reduced reliance on seaborne energy imports benefits its economy. Regional ties through the Belt and Road initiative allow China to fill growing infrastructure needs. This relative resilience bodes well for Chinese growth through ~2035, while Belt & Road trade networks boom through the 2026~2027 end of WW3:

Other winners include computing hardware manufacturers (🐂ASML,TSM), as 4IR and wartime chip demand accelerates, while geographically advantaged crypto:power producers (🐂SDIG,HUT,MARA) and correlated crypto and fintech assets serve as dynamic/safe havens. But overall, prolonged conflict and NATO fragmentation would spark deep uncertainty and volatility across global asset markets.

In conclusion, while all crises create winners and losers, they also increase systemic risks (cross asset volatility) and economic contagion. Nationalistic diplomacy and autarkic policy become increasingly vital the more globalization retreats and regional tensions grow. For anyone with net worth or significant cash flows, agility (liquid assets), cross-asset diversification, and calculated risk taking help us survive and thrive in these most interesting of times..

This is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.